Validators looking to fully exit the chain could be looking at a wait of up to 14 days, to get their crypto back, according to Rated Network’s explorer.

So many Ethereum validators have put in requests to unstake ether (ETH) from the blockchain following Wednesday’s Shanghai upgrade that the queue to get the cryptocurrency out has backed up to two weeks.

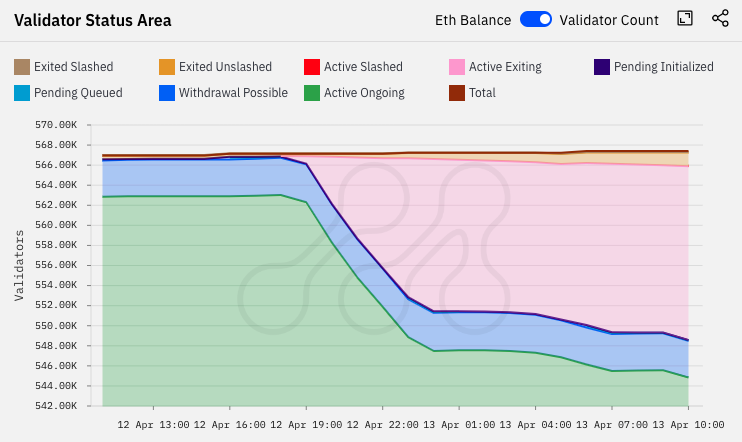

In the hours following the Shanghai upgrade, also referred to as Shapella – the “hard fork” or series of blockchain code changes that enabled staked ETH withdrawals for the first time – the number of validators waiting for redemptions has grown to about 17,000 for full withdrawals, and 285,000 for partial withdrawals, according to the network explorer. (There’s not total agreement in the market about this number; the blockchain analysis firm Nansen estimates it at about 22,000 for full withdrawals, while an Ethereum Foundation-sponsored data dashboard on the website Metrika also puts the number around 17,000.)

The total number of validators is about 567,000, according to Nansen, so the ones waiting for full withdrawals represent just 4%. A full withdrawal is when validators request back their entire original deposit of 32 ETH (about $64,000 worth), the amount that’s required to participate in the proof-of-stake network.

But also, the Ethereum blockchain appears to be processing the withdrawals at just 55.4% of its capacity, according to Rated.

The upshot is that there’s about a 14-day wait. That’s quite a bit longer than several blockchain analysts’ estimates prior to Shanghai – that it could take a few hours to a few days to get through the backlog.

Chart shows status of Ethereum validators post-Shanghai. The pink zone represents those “active exiting.” Note scale of chart is truncated, with vast majority in green or “active ongoing.” (Metrika)

Roughly 1,000 validators have fully exited the Beacon Chain.

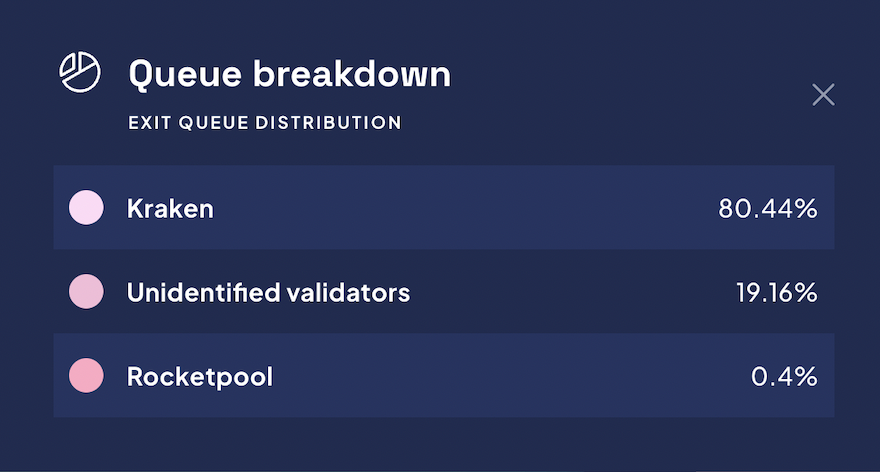

Blockchain analysts have noted that validators associated with Kraken, the crypto exchange, make up about 80% of that queue. That dynamic was expected since Kraken agreed in February to shut down its staking service in a settlement with the Securities and Exchange Commission.

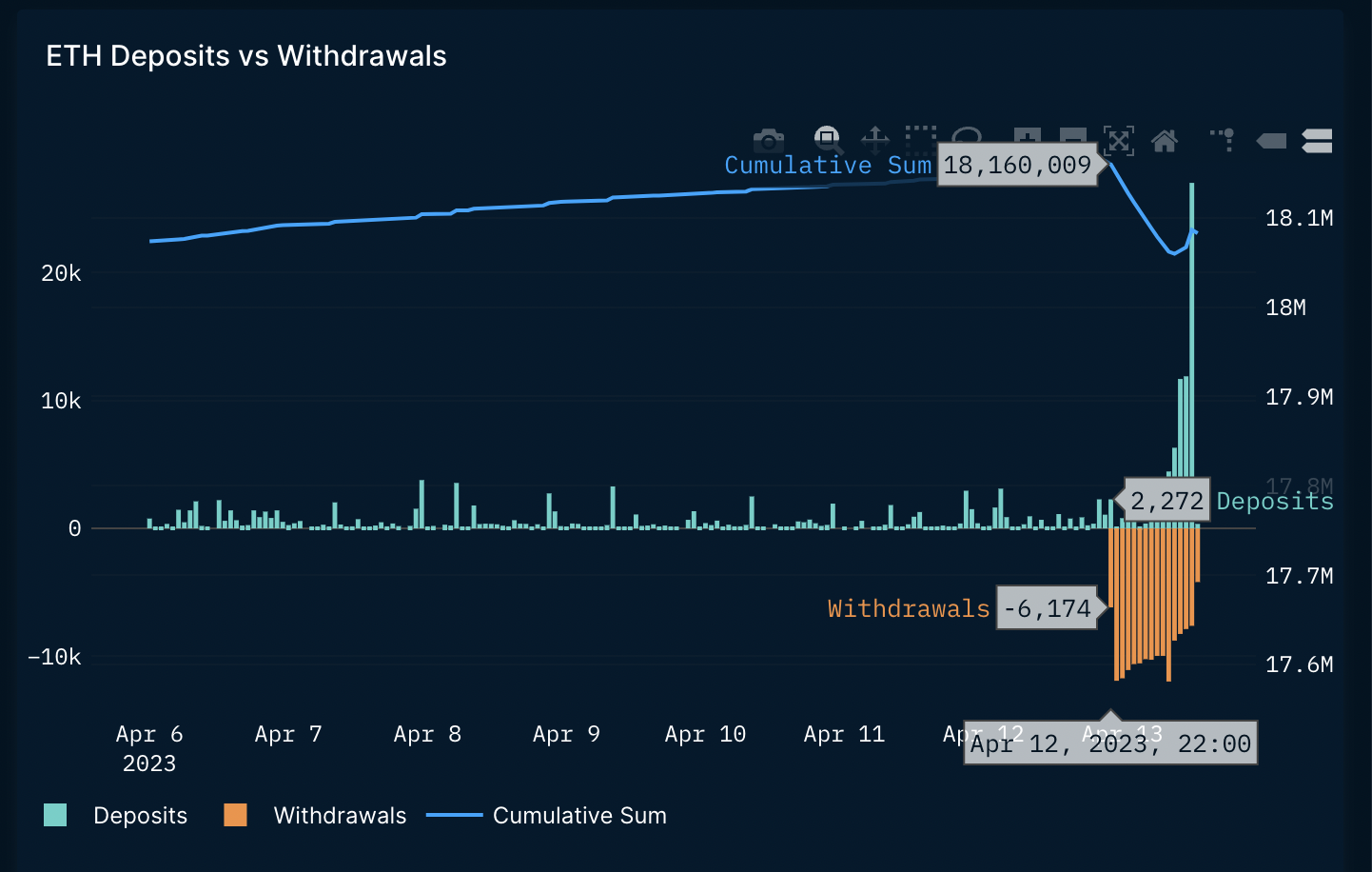

While stakers are starting to withdraw their accrued rewards, Nansen, a blockchain analytics provider, shows that ether (ETH) deposited into the Beacon Chain has started to grow, showing that stakers want to participate in Ethereum’s maintenance of the blockchain going forward.

But on a net basis, withdrawals still outweigh the deposits. The 24-hour net deposit change into the Beacon Chain currently stands at minus 79,488 ETH (minus 0.4%) at the time of publication.

Data about the Shanghai Upgrade will still be rolling in as more liquid staking providers also allow its users to withdraw their staked ETH.

Later Thursday, Coinbase, a cryptocurrency exchange that holds about 12.6% of all staked ETH, will allow its users to decide if they want to unstack.

Ethereum developers met today to debrief on Shanghai.

“Great work everyone on Shapella, it worked!” Tim Beiko, the protocol support lead at the Ethereum Foundation, said at the Ethereum All Core Developers execution layer meeting 159. “The network transitioned successfully. There were a couple of minor issues that we saw, but I think overall this was very smooth, and great work everyone!”